Amazon and Google: Two Different Investment Angles

July 1, 2018

I read “Alphabet Joins $300m Funding Round for Electric Scooter Start-Up.” (You may have to pay to read this because the outfit that thought Endeca was the next big thing in search charges for scooter stories.) I thought about Segways, the allegedly revolutionary personal transportation scooter. Lessons may be needed even though there once was a Segway polo league. Practical and no horsey duties after a match.

I assume that Alphabet Google sees smaller scooters as the next big thing. Is this a strategic investment, a tactical play, or just a nifty idea warranting Google bucks?

I thought about Amazon’s investment in PillPack. You can get some of the business information at this link.

Somewhere in Twitterland, an ink stained wretch may come up with the title for a post called “A Tale of Two Investments.” I would flip to the end of the write up to answer the question:

Which company is making a more strategic play?

From my vantage point in Harrod’s Creek, these two deals illustrate a difference between the GOOG and the Bezos buck machine. Younger people dig scooters. Scooters are fun.

Filling prescriptions and then following the orders of a real live doctor is another. Plus, some ageing American is into prescriptions. Boomers are a here and now market. I for one dislike going to the pharmacy, giving codes, showing IDs, and answering questions to get whatever my cardiologist thinks is good for me.

I assume that if a millennial falls off a scooter or is hit by an autonomous vehicle, that click to buy outfit will be ready to respond. Google will let the Lime rider snag another scooter when he or she is once again ready to move from Point A to Point B as long as it is not raining, snowing, too far, requires a jaunt on an expressway, or a short cut through a field.

Stephen E Arnold, July 1, 2018

Amazon: Information and Its Pharma Play

June 29, 2018

Amazon sells quite a few health related products. One I found interesting is Amazon’s hydrogen peroxide. That’s an interesting chemical, and I wondered who has order a higher concentration version. I assumed that Amazon could answer that question, among others; for example, who bought certain books describing the use of the compound.

I thought about Amazon’s health products when I read “Amazon to Buy Online Pharmacy PillPack, Jumping Into the Drug Business.” I think the deal is an interesting one, but my view is different. Hey, I live in rural Kentucky, one of the states associated with opioid abuse.

The news about the deal had an immediate impact on the outfits dedicated to putting store fronts selling soft drinks, batteries, and snacks on every corner. Oh, I almost forgot to mention that these Walgreen-type outfits are distribution points for medications prescribed by doctors. Amazon seems to be serious about disrupting how many people pick up their medicines, fill out forms for insurance, and provide endlessly repetitive details like their date of birth, insurance data, and home address.

Amazon assumes that it can make this traditional doctor-pharmacy-consumer business more efficient and make a buck along the way.

Several thoughts crossed my mind as I read the NYT story. Not surprisingly, these have not be mentioned in the NYT story or the other coverage I have scanned.

Let me share a handful of questions which struck me after reading the NYT write up.

- Will Amazon be able to determine what individuals are acquired specific medicines and place these data on a timeline?

- Will Amazon be able to determine what medications are flowing to specific geographic regions; for example, specific zip codes within the Commonwealth of Kentucky or any other geocoded area?

- Will Amazon be able to pinpoint the physicians, dentists, etc. who are prescribing specific medicines and array those data on a timeline or a compound output like those available from Palantir Gotham or IBM Analysts Notebook?

- Can Amazon cross correlate these medicine related data with other specific Amazon customer behavior?

- Can Amazon provide insights about possible improper script issuance, medical fraud, or other similar activity?

I assume that Amazon may not have these questions. Amazon sells books.

I want to raise a final question:

What if Amazon can process these drug related data in a way that reveals patterns, identifies abusers, or provides data to flag medical fraud?

- If the answer is no, that’s okay with most Amazon customers.

- If the answer is yes, that suggests a number of other questions.

Amazon is an interesting company indeed.

Stephen E Arnold, June 29, 2018

Amazon Intelligence Gets a New Data Stream

June 28, 2018

I read “Amazon’s New Blue Crew.” The idea is that Amazon can disintermediate FedEx, UPS (the outfit with the double parking brown trucks), and the US Postal Service.

On the surface, the idea makes sense. Push down delivery to small outfits. Subsidize them indirectly and directly. Reduce costs and eliminate intermediaries not directly linked to Amazon.

FedEx, UPS, and the USPS are not the most nimble outfits around. I used to get FedEx envelopes every day or two. I haven’t seen one of those for months. Shipping vis UPS is a hassle. I fill out forms and have to manage odd slips of paper with arcane codes on them. The US Postal Services works well for letters, but I have noticed some returns for “addresses not found.” One was an address in the city in which I live. I put the letter in the recipient’s mailbox. That worked.

The write up reports:

The new program lets anyone run their own package delivery fleet of up to 40 vehicles with up to 100 employees. Amazon works with the entrepreneurs — referred to as “Delivery Service Partners” — and pays them to deliver packages while providing discounts on vehicles, uniforms, fuel, insurance, and more. They operate their own businesses and hire their own employees, though Amazon requires them to offer health care, paid time off, and competitive wages. Amazon said entrepreneurs can get started with as low as $10,000 and earn up to $300,000 annually in profit.

Now what’s the connection to Amazon streaming data services and the company’s intelligence efforts? Several hypotheses come to mind:

- Amazon obtains fine grained detail about purchases and delivery locations. These are data which no longer can be captured in a non Amazon delivery service system

- The data can be cross correlated; for example, purchasers of a Kindle title with the delivery of a particular product; for example, hydrogen peroxide

- Amazon’s delivery data make it possible to capture metadata about delivery time, whether a person accepted the package or if the package was left at the door and other location details such as a blocked entrance, for instance.

A few people dropping off packages is not particularly useful. Scale up the service across Amazon operations in the continental states or a broader swatch of territory and the delivery service becomes a useful source of high value information.

FedEx and UPS are ripe for disruption. But so is the streaming intelligence sector. Worth monitoring this ostensible common sense delivery play.

Stephen E Arnold, June 28, 2018

Google: A Good Digital Neighbor

June 20, 2018

Amazon’s retail and technology power daily grows. The only way to compete with Amazon is to have products, power, money, and exposure. Other companies have the money and products, while Google has the power and exposure. With their powers combined, Amazon might start to quack…just a little. Engadget reports on, “Google Plans To Boost Amazon Competitors In Search Shopping Ads.”

Target, Home Depot, Walmart, Costco, Ulta and other retailers are allowing Google to index their catalogs and will appear in search results. Instead of getting an ad fee, Google will get a cut from the sale. The immediate concern is that this will pollute organic search results, but Google will separate the targeted sale searches in a sidebar

Google is selling this package as an anti-Amazon tool:

“The report claims that Google is selling its new anti-Amazon tools on the basis that it is utterly dominant in the search world. Not to mention that, as voice becomes a more important component of people’s lives, Google’s reach here will help beat back Alexa. The project’s genesis was reportedly down to the company noticing that people were image searching products, or asking where they could buy an item. And it wasn’t small numbers of folks, either, but tens of million of people, a big enough market to make anyone excited.”

The brick and mortar retailers can steal back some of their customers by embedding their results in Google searches. According to the research, most searches start with Google, but they end up on Amazon. Google has seen a modest 30 percent increase retailer sales in another shopping project, Google Express, and those results could increase with this new endeavor. Google anti-Amazon sales kit is made for the changing world, where shopping is easier with your voice or from a computer.

Amazon has a reasonable position in the retail market, which could be seen as a positive or a negative, depending on one’s point of view. Google is just trying to be a good digital neighbor. Fences, digital fences.

Whitney Grace, June 20, 2018

Amazon: A Variant of the Google Push Back Problem

June 19, 2018

Google sells online ads and tries hard to generate significant, sustainable revenue not dependent on its “pay to play” model. The Google has faced employee pushback from employees related to its work for the US government. Although the focus has been Project Maven, some employees are not supportive of the company’s interest in expanding its work for US government agencies.

The Google problem has now morphed and allegedly surfaced among Amazon shareholders. The objection is that Amazon is working hard to expand its revenue by providing services to government agencies. The focus is upon Rekognition, the company’s facial recognition system.

The source which alerted me to this “problem” is CNNMoney. I assume that some of the information in the write up is accurate, but in today’s digital media sphere, one never knows. Nevertheless, let me highlight a couple of the points in “Amazon Shareholders Call for Halt of Facial Recognition Sales to Police.”

I know from the feedback from the audience at my lectures in Prague is that Amazon is not recognized as a vendor of policeware. (“Policeware” is the term I use to describe technology packaged for use by law enforcement and intelligence professionals.) In fact, when I mentioned “policeware” in conjunction with Amazon’s Rekognition service, there was confusion on the faces of my audience.

In short, Amazon may be selling facial recognition technology in the US, but among the professionals in Prague, Amazon sells T shirts and electronic gizmos.

The CNN Tech / CNNMoney write up states:

In a letter delivered to CEO Jeff Bezos late Friday, the shareholders, many of whom are advocates of socially responsible investing, say they’re concerned about the privacy threat of government surveillance from the tool.

Amazon rolled out Rekognition in 2016. Now two years later, the push back is sufficiently “large” to catch the attention of the “real” journalists at CNN.

The write up points out:

The shareholders, which include the Social Equity Group and Northwest Coalition for Responsible Investment, are joining groups such as the ACLU in efforts to stop the company from selling the service — pointing out the risks of mass surveillance.

Amazon’s technology, it seems based on the information in the write up, is suitable for mass surveillance.

I highlighted this statement attributed to University of District Columbia law professor Andrew Guthrie Ferguson, author of “The Rise of Big Data Policing”:

The implications of Amazon Rekognition and all new facial recognition technologies is nothing less than a rebalancing of power between citizens and the police. The ability to identify, track, and monitor everyone throughout the city is something that we read about in science fiction.

Interesting.

Perhaps the “real” journalists at CNN will explore this topic in the future articles.

I have some questions which the experts working with CNN may be able to answer:

- If the Rekognition product became available in 2016, how many years of development did Amazon require before having a commercial service?

- What other innovations related to Rekognition did Amazon fund and develop?

- How does Rekognition’s capabilities relate to the video functions of some Amazon in home devices?

- Who spearheads Amazon’s policeware activities?

Perhaps CNN will provide additional information? If not, there may be some experts who can tackle these questions. Amazon may have to direct its attention to curing its variant of the Google disease for push back and discontent.

Stephen E Arnold, June 19, 2018

Amazon Scraper

June 12, 2018

Short honk: Want to scrape Amazon content?

Amazon has renamed a previous tool and released it as open source. Navigate to Microsoft’s GitHub and download Amz2csv. The tool performs as advertised.

One question which we are pondering is, “Why is Amazon releasing this tool as open source?”

We also wondered, “What other content acquisition tools and filters does Amazon possess?”

Stephen E Arnold, June 12, 2018

Forbes Does a Semi Rah Rah for Amazon Rekognition

June 9, 2018

I ran through some of our findings about Amazon’s policeware capabilities. Most of the individuals who heard my lectures were surprised that an eCommerce vendor offered high value tools, products, and services directly useful for law enforcement and intelligence professionals.

Why the surprise?

I think there are a number of reasons. But based on conversations with those in my lectures, two categories of comments and questions capture the reaction to the US government documents I reviewed.

First, Europeans do not think about Amazon as anything other than a vendor of products and a service which allows relatively low cost backend services like storage.

Second, the idea that a generalist online eCommerce site and a consumerized cloud service could provide industrial strength tools to investigators, security, and intelligence professionals was a idea not previously considered.

I read what might be an early attempt by the US media to try and explain one small component in Amazon’s rather large policeware system. In “We Built A Powerful Amazon Facial Recognition Tool For Under $10,” a member of the magazine’s staff allegedly “built” a facial recognition system using Amazon’s Rekognition service.

I learned:

because Rekognition is open to all, Forbes decided to try out the service. Based on photos staff consensually provided, and with footage shot across our Jersey City and London offices, we discovered it took just a few hours, some loose change and a little technical knowledge to establish a super-accurate facial recognition operation.

Based on my experience with professionals who work in the field of “real” news and journalism, the Amazon system must be easy to use. Like lawyers, many journalists are more comfortable with words that technology. There are, of course, exceptions such as the Forbes’ journalist.

In order to present a balanced viewpoint, Forbes included a cautionary chunk of information from a third party; to wit:

“This [Rekognitioin] underscores how easily a government can deploy Amazon’s face recognition to conduct mass surveillance,” ACLU technology and civil liberties attorney Matt Cagle said of Forbes’ project. “Now it’s up to Amazon. Will it stop selling dangerous technology to the government? Or will it continue compromising customer privacy and endangering communities of color, protesters and immigrants, who are already under attack in the current political climate?”

What did Amazon contribute to the write up? It appears Amazon was okay with keeping its lips zipped.

I think it may take some time for the person familiar with Amazon as a source of baby diapers to embrace Amazon as a slightly more robust provider of certain interesting technology.

Our research has revealed that Amazon has other policeware services and features sitting on a shelf in a warehouse stuffed with dog food, cosmetics, and clothing. We offer a for fee briefing about Amazon’s policeware. Write benkent2020 at yahoo dot com for details.

Stephen E Arnold, June 11, 2018

Short Honk: Does Amazon Have Facebook Data?

June 5, 2018

I read “Facebook Gave Device Makers Deep Access to Data on Users and Friends.” The write up mentions Amazon as a company given “access to vast amounts of its users’ personal information.” So the answer appears to be “Yes.” I assume that the NYT report is “real” news. What can Amazon do with that data? Check out the Amazon analysis in this week’s DarkCyber.

Stephen E Arnold, June 5, 2018

DarkCyber for June 5, 2018: Amazon and Its LE and Intelligence Services

June 5, 2018

The DarkCyber for June 5, 2018, is now available at www.arnoldit.com/wordpress or on Vimeo at https://vimeo.com/273170550.

This week’s DarkCyber presents an extract from Stephen E Arnold’s lectures at the Prague Telestrategies ISS conference. The conference is designed for security, intelligence, and law enforcement professionals in Europe.

Stephen’s two lectures provided attendees with a snapshot of the services Amazon’s streaming data marketplace offer to customers, developers, and entrepreneurs.

Stephen said:

The Amazon platform is positioned to provide a robust, innovative way to anonymize digital currency transactions and perform the type of analyses needed to deal with bad actors and the activities.

The information was gleaned from Amazon conference lectures, Amazon’s Web logs and documentation, and open source documents.

For example, one public document stated:

“… A law enforcement agency may be a customer and may desire to receive global Bitcoin transactions, correlated by country, with USP data to determine source IP addresses and shipping addresses that correlate to Bitcoin addresses.”

Coupled with Amazon’s facial recognition service “Rekognition” and Amazon’s wide array of technical capabilities, Amazon is able to provide specialized content processing and data services.

Stephen stated:

Instead of learning how to use many different specialized systems, the Amazon approach offers a unified capability available with a Kindle-style interface. This is a potential game changer for LE, intel, and security service providers.

In this week’s DarkCyber video, Stephen provides an eight minute summary of his research, including the mechanisms by which new functions can be added to or integrated with the system.

A for fee lecture about what Stephen calls “Amazon’s intelligence services” is available on a for fee basis. For information, write darkcyber333 at yandex dot com.

Kenny Toth, June 5, 2018

One View of the Amazon Game Plan

May 27, 2018

I read “Invisible Asymptotes.” Job One for me was trying to match the meaning of “asymptote” with the research my DarkCyber team has conducted into one slice of Amazon’s business roll outs in the last three years.

As you know, an “asymptote” is a mathy way of saying “you can’t get from here to there.” According to Wolfram Mathword:

An asymptote is a line or curve that approaches a given curve arbitrarily closely.

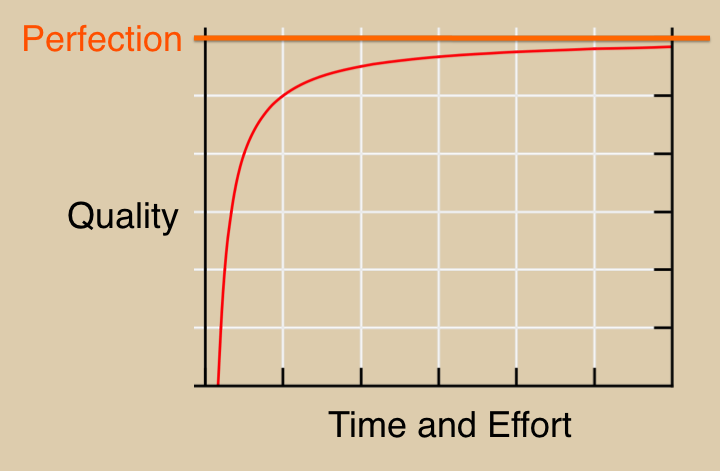

Here’s a diagram. No equations, I promise.

This diagram suggests a business angle to the “asymptote” reference: No matter what you do, it requires effort and a commitment to “quality”. The good news is that although one can quantify time, one cannot quantify “quality” or “perfection.” Okay, gerbil, run in that Ferris wheel gizmo in your cage.

The write up points out:

We focus so much on product-market fit, but once companies have achieved some semblance of it, most should spend much more time on the problem of product-market unfit.

I am not exactly sure what “unfit” means. The author provides a hint:

For me, in strategic planning, the question in building my forecast was to flush out what I call the invisible asymptote: a ceiling that our growth curve would bump its head against if we continued down our current path.

Okay, the idea seems to be that if Amazon enters a new market, the “invisible asymptote” is what slows growth or stops it completely. (Is this the Amazon phone’s and the slowing sales of Alexa in the face of competition from the Google Home device?)

The reason Amazon cannot grow ever larger is because of an “invisible asymptote”; that is, a factor which prevents Amazon from becoming a company that Vanderbilt, JP Morgan, and John D. Rockefeller would have wished they had.

The write up does not discuss Amazon’s semi-new entrance into the law enforcement and intelligence market. That’s a push I am exploring in my lecture at the Telestrategies ISS conference in early June.

The focus shifts to a more mundane and increasingly problematic aspect of Amazon’s business: Shipping fees. Fiat, law, and the costs of fuel are just a few of the challenges Amazon faces. I am not sure these are “invisible”, but let’s trudge forward.

Twitter becomes that foundation for social media. I noted this passage:

No company owes it to others to allow people to build direct competitors to their own product.

If Amazon wants to make law enforcement and intelligence services into a major revenue stream, I think the first evidence of this intent will be cutting off the vendors using Amazon’s infrastructure to serve their clients now. (Keep in mind that most of the specialist vendors in the LE and intel space use Amazon as plumbing. To cite one example, Marinus, the anti human trafficking group, follows this approach.

The author brings up Snapchat and other social media companies. I find this example important. Amazon’s facial recognition capabilities hit out radar when my team was assembling “CyberOSINT: Next Generation Information Access”, written in 2014 and published in 2015.

We did not include Amazon in my review of LE and intel tools because I had only references in some Amazon conference videos, a few patent applications which were particularly vague about applications in the Background and Claims sections of the documents, and chatter at meetings I attended.

The American Civil Liberties Union has made a bit of noise about Amazon’s facial recognition system. Recognition is spelled “rekognition”, presumably to make it easy to locate in the wonky world of Bing and Google search. The reason is that Amazon’s facial recognition system can identify individuals and cross tabulate that piece of information with other data available to the Amazon system.

Instant bubblegum card.

The write up “Invisible Asymptote” talks about social content and social rich media without offering any comment about the importance of these types of data to Amazon’s intelligence services or its marketplace.

The conclusion of the 10,000 word essay is more “invisible asymptote”. Is this Amazon’s the secret sauce:

Lastly, though I hesitate to share this, it is possible to avoid invisible asymptotes through sheer genius of product intuition.

Here’s a diagram from the essay which looks quite a bit like the self help diagram I included at the top of this Beyond Search post:

Several observations:

- The write up makes clear that if anyone thinks Amazon’s platform is neutral, think again.

- Strategists at Amazon are not able to “see” and “explain” the nuts and bolts of the “we may be a monopoly but” approach of the Big Dog of the Amazon

- The long, long essay does not stray very far from selling stuff to consumers who love free shipping.

Taken as a group of three perceptions, what does this say about Amazon?

For me, I think companies using Amazon’s plumbing will want to do a bit of strategizing using “What if” questions to spark discussion.

For companies behind or beneath the curve, there will be a ceiling, and it will not be easy to break through.

Amazon, on the other hand, may have break through and then replace the old ceiling with a nifty new one made of sterner stuff.

For information about our lectures about Amazon’s Next Big Thing: Intelligence Services, write me at benkent2020@yahoo.com. Put Amazon Streaming Marketplace in the subject line, please.

We now offer for fee webinars and on site consulting sessions. On June 5, 2015, coincident with my two lectures in Prague before an audience of LE and intel professionals, I will release a nine minute DarkCyber video exploring some of the inventions Amazon disclosed in an April document not widely reported in the media. Watch this blog for a link.

Stephen E Arnold, May 27, 2018