Telegram Notes: AI Slop Analyzes TON Strategy and Demonstrates Shortcomings

January 1, 2026

![green-dino_thumb_thumb[3] green-dino_thumb_thumb[3]](https://www.arnoldit.com/wordpress/wp-content/uploads/2025/12/green-dino_thumb_thumb3_thumb-2.gif) Another dinobaby post. No AI unless it is an image. This dinobaby is not Grandma Moses, just Grandpa Arnold.

Another dinobaby post. No AI unless it is an image. This dinobaby is not Grandma Moses, just Grandpa Arnold.

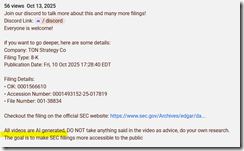

If you want to get a glimpse of AI financial analysis, navigate to “My Take on TON Strategy’s NASDAQ Listing Warning.” The video is ascribed to Corporate Decoder. But there is no “my” in the old-fashioned humanoid sense. Click on the “more” link in the YouTube video, and you will see this statement:

The highlight points to the phrase, “All videos are AI generated…”

The six minute video does not point out some of the interesting facets of the Telegram / TON Foundation inspired “beep beep zoom” approach to getting a “rules observing listing” on the US NASDAQ. Yep, beep beep. Road Runner inspired public lists with an alleged decade of history. I find this fascinating.

The video calls attention to superficial aspects of the beep beep Road Runner company spun up in a matter of weeks in late 2025. The company is TON Strategy captained by Manny Stotz, formerly the president or CEO or temporary top dog at the TON Foundation. That’s the outfit Pavel Durov thought would be a great way to convert GRAMcoin into TONcoin, gift the Foundation with the TON blockchain technology, and allow the Foundation to handle the marketing. (Telegram itself does not marketing except leverage the image of Pavel Durov, the self-proclaimed GOAT of Russian technology culture. In addition to being the GOAT, Mr. Durov is reporting to his nanny in the French judiciary as he awaits a criminal trial on nine or ten serious offenses. But who is counting?

What’s the AI video do other than demonstrate that YouTube does not make easily spotted AI labels obvious.

The video does not provide any insight into some questions my team and I had about TON Strategy Company, its executive chairperson Manual “Manny” Stotz, or the $400 million plus raised to get the outfit afloat. The video does not call attention to the presence of some big, legitimate, brands in the world of crypto like Blockchain.com.

The video tries to explain that the firm is trying to become an asset outfit like Michael Saylor’s Strategy Company. But the key difference is not pointed out; that is, Mr. Saylor bet on Bitcoin. Mr. Stotz is all in on TONcoin. He believes in TONcoin. He wanted to move fast. He is going to have to work hard to overcome what might be some modest potholes as his crypto vehicle chugs along the Information Highway.

The first crack in the asphalt is the TONcoin itself. Mr. Stotz “bought” TONcoins at about a value point of $5.00. That was several weeks ago. Those same TONcoins can be had for $1.62 at about noon on December 31, 2025. Source you ask? Okay, here’s the service I consulted: https://www.tradingview.com/symbols/TONUSD/

The second little dent in the road is the price of the TON Strategy Company’s NASDAQ stock. At about noon on December 31, 2025, it was going for $2.00 a share. What did the TONX stock cost in September 2025? According to Google Finance it was in the $21.00 range. Is this a problem? Probably not for Mr. Stotz because his Kingsway Capital is separate from TON Strategy Company. Plus, Kingsway Capital is separate from its “owner” Koenigsweg Holdings. Will someone care if TONX gets delisted? Yep, but I am not prepared to talk about the outfits who have an interest in Koenigsweg and Kingsway. My hunch is that a couple of these outfits may want to take a ride with Manny to talk, to share ideas, and to make sure everyone is on the same page. In Russian, Google Translate says this sequence of words might pop up during the ride: ?? ?????????, ??????

What are some questions the AI system did not address? Here are a few:

- How does the current market value of TONcoin affect the information in the SEC document the AI analyzed?

- Where do these companies fit into the TON Strategy outfit? Why the beep beep approach when two established outfits like Kingsway Capital and Koenigsweg Holdings could have handled the deal?

- What connections exist between the TON Foundation and Mr. Stotz? What connection does the deal have to the TON Foundation’s ardent supported, DWF Labs (a crypto market maker of repute)?

- Who is president of the TON Strategy Company? What is the address of the company for the SEC document? Where does Veronika Kapustina reside in the United States? Why do Rory Cutaia, Veronika Kapustina, and TON Strategy Company share a residential address in Las Vegas?

- What role does Sarah Olsen, a former Rockefeller financial analyst play in the company from her home, possibly in Miami, Florida?

- What is the Plan B if the VERB-to-TON Strategy Company continues to suffer from the down market in crypto? What will outfits like DWF Labs do? What will the TON Foundation do? What will Pavel Durov, the GOAT, do in addition to wait for the big, sluggish wheels of the French judicial system to grind forward?

The AI did not probe like an over-achieving MBA at an investment firm would do to keep her job. Nope. Hit the pause switch and use whatever the AI system generates. Good enough, right?

What does this AI generated video reveal about smart software playing the role of a human analyst? Our view is:

- Quick and sloppy content

- Failure to chase obvious managerial and financial loose ends

- Ignoring obvious questions about how a “sophisticated” pivot can garner two notes from Mother SEC in a couple of weeks.

Net net: AI is not ready for some types of intellectual work.

Want for more Telegram Notes’ content? More information about our Telegram-related information service in the new year.

Stephen E Arnold, January 1, 2026

The Google: Indexing and Discriminating Are Expensive. So Get Bigger Already

November 9, 2022

It’s Wednesday, November 9, 2022, only a few days until I hit 78. Guess what? Amidst the news of crypto currency vaporization, hand wringing over the adult decisions forced on high school science club members at Facebook and Twitter, and the weirdness about voting — there’s a quite important item of information. This particular datum is likely to be washed away in the flood of digital data about other developments.

What is this gem?

An individual has discovered that the Google is not indexing some Mastodon servers. You can read the story in a Mastodon post at this link. Don’t worry. The page will resolve without trying to figure out how to make Mastodon stomp around in the way you want it to. The link to you is Snake.club Stephen Brennan.

The item is that Google does not index every Mastodon server. The Google, according to Mr. Brennan:

has decided that since my Mastodon server is visually similar to other Mastodon servers (hint, it’s supposed to be) that it’s an unsafe forgery? Ugh. Now I get to wait for a what will likely be a long manual review cycle, while all the other people using the site see this deceptive, scary banner.

So what?

Mr. Brennan notes:

Seems like El Goog has no problem flagging me in an instant, but can’t cleanup their mistakes quickly.

A few hours later Mr. Brennan reports:

However, the Search Console still insists I have security problems, and the “transparency report” here agrees, though it classifies my threat level as Yellow (it was Red before).

Is the problem resolved? Sort of. Mr. Brennan has concluded:

… maybe I need to start backing up my Google data. I could see their stellar AI/moderation screwing me over, I’ve heard of it before.

Why do I think this single post and thread is important? Four reasons:

- The incident underscores how an individual perceives Google as “the Internet.” Despite the use of a decentralized, distributed system. The mind set of some Mastodon users is that Google is the be-all and end-all. It’s not, of course. But if people forget that there are other quite useful ways of finding information, the desire to please, think, and depend on Google becomes the one true way. Outfits like Mojeek.com don’t have much of a chance of getting traction with those in the Google datasphere.

- Google operates on a close-enough-for-horseshoes or good-enough approach. The objective is to sell ads. This means that big is good. The Good Principle doesn’t do a great job of indexing Twitter posts, but Twitter is bigger than Mastodon in terms of eye balls. Therefore, it is a consequence of good-enough methods to shove small and low-traffic content output into a area surrounded by Google’s police tape. Maybe Google wants Mastodon users behind its police tape? Maybe Google does not care today but will if and when Mastodon gets bigger? Plus some Google advertisers may want to reach those reading search results citing Mastodon? Maybe? If so, Mastodon servers will become important to the Google for revenue, not content.

- Google does not index “the world’s information.” The system indexes some information, ideally information that will attract users. In my opinion, the once naive company allegedly wanted to achieve the world’s information. Mr. Page and I were on a panel about Web search as I recall. My team and I had sold to CMGI some technology which was incorporated into Lycos. That’s why I was on the panel. Mr. Page rolled out the notion of an “index to the world’s information.” I pointed out that indexing rapidly-expanding content and the capturing of content changes to previously indexed content would be increasingly expensive. The costs would be high and quite hard to control without reducing the scope, frequency, and depth of the crawls. But Mr. Page’s big idea excited people. My mundane financial and technical truths were of zero interest to Mr. Page and most in the audience. And today? Google’s management team has to work overtime to try to contain the costs of indexing near-real time flows of digital information. The expense of maintaining and reindexing backfiles is easier to control. Just reduce the scope of sites indexed, the depth of each crawl, the frequency certain sites are reindexed, and decrease how much content old content is displayed. If no one looks at these data, why spend money on it? Google is not Mother Theresa and certainly not the Andrew Carnegie library initiative. Mr. Brennan brushed against an automated method that appears to say, “The small is irrelevant controls because advertisers want to advertise where the eyeballs are.”

- Google exists for two reasons: First, to generate advertising revenue. Why? None of its new ventures have been able to deliver advertising-equivalent revenue. But cash must flow and grow or the Google stumbles. Google is still what a Microsoftie called a “one-trick pony” years ago. The one-trick pony is the star of the Google circus. Performing Mastodons are not in the tent. Second, Google wants very much to dominate cloud computing, off-the-shelf machine learning, and cyber security. This means that the performing Mastodons have to do something that gets the GOOG’s attention.

Net net: I find it interesting to find examples of those younger than I discovering the precise nature of Google. Many of these individuals know only Google. I find that sad and somewhat frightening, perhaps more troubling than Mr. Putin’s nuclear bomb talk. Mr. Putin can be seen and heard. Google controls its datasphere. Like goldfish in a bowl, it is tough to understand the world containing that bowl and its inhabitants.

Stephen E Arnold, November 9, 2022

Sepana: A Web 3 Search System

November 8, 2022

Decentralized search is the most recent trend my team and I have been watching. We noted “Decentralized Search Startup Sepana Raises $10 Million.” The write up reports:

Sepana seeks to make web3 content such as DAOs and NFTs more discoverable through its search tooling.

What’s the technical angle? The article points out:

One way it’s doing this is via a forthcoming web3 search API that aims to enable any decentralized application (dapp) to integrate with its search infrastructure. It claims that millions of search queries on blockchains and dapps like Lens and Mirror are powered by its tooling.

With search vendors working overtime to close deals and keep stakeholders from emulating Vlad the Impaler, some vendors are making deals with extremely interesting companies. Here’s a question for you? “What company is Elastic’s new best friend?” Elasticsearch has been a favorite of many companies. However, Amazon nosed into the Elastic space. Furthermore, Amazon appears to be interested in creating a walled garden protected by a moat around its search technologies.

One area for innovation is the notion of avoiding centralization. Unfortunately online means that centralization becomes an emergent property. That’s one of my pesky Arnold’s Laws of Online. But why rain on the decentralized systems parade?

Sepana’s approach is interesting. You can get more information at https://sepana.io. Also you can check out Sepana’s social play at https://lens.sepana.io/.

Stephen E Arnold, November 8, 2022