Alphabet Google: Our Survival As an Idea

October 22, 2015

I read an interesting item in Slashdot. Here it is:

Speaking at the Wall Street Journal’s WSJD Live Conference, Google’s senior vice president of adverts and commerce Sridhar Ramaswamy has said (paywalled) that advertisers need to address the shortcomings of online ads within ‘months’. “This is essential to our survival” said Ramaswamy. “We’re talking about getting this in a time frame of months rather than years. We need to get going on this.” Ramaswamy was referring to recent commitment from the advertising industry to halt the rise of adblocking services by addressing common reader annoyances such as autoplay video, overly complex and slow-loading content, and excessive tracking.

Three thoughts:

- Note the phrase “our survival.” Alphabet Google thinking about failure in its only significant revenue stream?

- Note the absence of reference to search and, of course, objectivity in search results

- Note the refreshing omission of references to home automation, Loon balloons, and “solving” death.

Is Google thinking about old age, the retirement option, and its limitations? With YouTube subscriptions and differential pricing for the Apple crowd, a new phase of the Alphabet Google thing takes shape.

Stephen E Arnold, October 22, 2015

The Alphabet Google Thing: The Crunch Cometh

October 22, 2015

I am in a remote location with so so Internet—sometimes. I wanted to capture this write up “Google’s Growing Problem: 50% of People Do Zero Searches per Day on Mobile.” It is not the good old days from 2002 to 2006 for the GOOG. What happens when most of the folks in this third world country in which I sojourn get online? Well, I don’t think that the users will be doing the 2002-2006 search for information. I also think that zippy new users will embrace social media, apps, or maybe not search at all. Smart software can be convenient. According to the write up:

Thus where someone using a desktop/laptop might fulfil their “average” one or two searches per day by typing “Facebook” when they open their browser, on mobile that doesn’t happen because it doesn’t need to happen; they just open the app. For Google, that means it’s losing out, even though Google search is front and centre on every Android phone (as per Google’s instructions as part of its Mobile Application Device Agreement, MADA). People don’t, on average, search very much on mobile.

Is this a cup half full or half empty issue? Maybe Google can sustain its top line revenue growth. I suppose it has little choice, since the company after 15 years is almost completely dependent on a single revenue stream. On the other hand, perhaps the engine which floats the Loon balloons will run out of hot air?

Stephen E Arnold, October 22, 2015

Quote to Note: HP Comments on Dell EMC Deal

October 13, 2015

“HP Enterprise’s Whitman Pans Dell’s EMC Purchase over Debt” reproduced a memorandum allegedly written by Hewlett Packard’s big dog. I highlighted one passage as a keeper. Here it is:

…this [Dell paying $67 billion for EMC] is a good thing for Hewlett Packard Enterprise and an opportunity for us to seize the moment. This is validation for the strategy that we have laid out and I am not surprised that others would try to emulate it.

Yes, HP’s strategy is something that Dell is emulating. The flaw in Dell’s “validation” is that it did not purchase a search and retrieval company. Now the Dell plan is one that may work out. On the other hand, it may work out only for those involved in the financial and legal activities.

How many other companies will be emulating HP’s strategies? Show of hands, please. Anyone?

Stephen E Arnold, October 13, 2015

Alphabet Google: Dreams of a Churning Welchian

October 10, 2015

I like the name General Electric. I liked the acronym GE. I am not sure about abc.xyz or abcdefghijklmnopqrstuvwxyz.com. I like the idea of an industrial company emulating GE or one of its Welchian variants. I am okay with GE becoming a software company. GE still makes jet engines, which in time of war may become a hot selling item.

Alphabet Google does not suggest a new version of GE. Alphabet Google does remind some Wall Street wizards of GE. That’s probably because there was a GE centric case at their business school and general awareness of Mr. Welch’s books and personal life. Who knew excitement brewed at the Harvard Business Review? Not me.

I read a woulda coulda shoulda write up called “Google’s Alphabet Could Become the Next GE.” Since we are dealing with supposition and hypothesis, let’s follow the logic.

According to the write up:

For GE, the success of the light bulb became a foundation for diversification and market dominance in areas like aircraft engines, oil and gas, and financial services. Similarly, the success of Google search will be the foundation to new products and services like hardware division Nest, its Life Sciences unit, and shipping, logistics, and shopping service, Express.

GE made stuff. Google sells ads. GE made more stuff, dallied in finance and a number of other disciplines and is now reinventing itself. I think Siemens is doing the same thing.

Google does bits and now wants to do many, many other things. The interests range from balloons to solving death, from doing evil to do the right thing, from controlling mobile phones to making money from said phones.

The write up asserts that Google can make a lot of money from home automation, life sciences (the death thing), local commerce, and broadband (just like AT&T and Verizon, bless their copper wire Bell heads). If these bets were not sufficient, the write up suggests that Alphabet can spell money with virtual reality, drones, and investments.

No mention of robots which are likely to be a hot property if there is a rapid shift from humans on the front line to robots in formation.

The write up points out that the parallel is not perfect. Okay, nice hedge. But it seems to me that my view from Harrod’s Creek is slightly different:

- Google (the old ad thing) is under lots of legal pressure. The reorganization may put some other folks in depositions and in court rooms.

- The big dogs at Google are bored and want to do more interesting things. Solving death is probably interesting because disease, ageing, and weird protein dances can trim one’s options. The efforts are, from my vantage point, math and science club projects. My hunch is that significant revenue may arrive but one has to sell something people want; for example, light bulbs.

- The search business is not an intellectual challenge. Search is now commoditized. There are alternatives to Google if one pokes around a bit. Academic interests? Well, check out iSeek.com. General search? A combination of Yandex with one of the start up search systems like Qwant.com or Unbubble.eu might fill the gap. Want a pizza? Let the iPhone deliver.

Net net: Google is more like a microwaved version of Jimmy Ling’s vision. The structure, the diversity, and the sheer complexity of the LTV operation may be in Alphabet’s future.

Let’s talk turkey. Google’s revenue derives from ads. Prior to the Google IPO a legal dust up with Yahoo about the Overture/GoTo business model was resolved. Hooray for struggling Yahoo. Since the IPO Google has been unable to diversify its revenues. Look at the digital Wal-Mart-type outfit that Amazon has become. Good or bad, Amazon has diversified its revenues. To top off its success, Amazon won’t sell stuff from Google which won’t show Amazon videos. Yikes. Google has remained for more than a decade what Steve Ballmer called a one trick pony.

Now I am supposed to believe that this one trick parva equitum will morph into Northern Dancer’s progeny. I am skeptical, but I don’t have to earn my living whipping up excitement for a company increasingly well known in legal circles. Even Jack Welch dreams about what could be I assume. We know analysts do. Google does science projects.

Stephen E Arnold, October 10, 2015

Privacy Centric Hulbee Secures $9 Million

October 10, 2015

You can search the Web and, in theory, not be tracked. Navigate to Hulbee and enter your query. You may want to do some exploratory clicking to figure out how Hulbee is helping you find the information you want. You can set your default search engine if you use the Alphabet Google Chrome beastie.

According to “Hulbee Bags $9M To Grow Its Pro-Privacy Search Engine,” the system is a Swiss based semantic search company. The write up points out:

It also has its own ad system, rather than bolting on a third party ad network. And again here it’s taking a non-tracking approach. Ads on Hulbee are targeted based on the search query, according to CEO Andreas Wiebe, so there’s no geotargeting or cumulative tracking. (Although users can specify their region in order to ensure more relevant search results, so it may have basic country data. And once you step off Hulbee and onto whatever website you were trying to find chances are their ad networks will start tracking you, unless you’re running an ad blocker…)

Yep, privacy is job one for advertising. Take a moment to explore this system. You may want to compare its output to that of Ixquick and Unbubble, two other privacy oriented outfits.

Stephen E Arnold, October 10, 2015

Technology and Dark Matter: Confusion an Undesirable Force for Some

October 7, 2015

By chance, my Overflight system spit out two articles which I read one after the other.

The first was “Technological Dark Matter.” The second was “The Tyranny of Choice: Why Enterprise Tech Buyers Are Confused.” Information access mavens seem to be drifting into a philosophical mode. Deeper thinking is probably needed. Superficial thinking is not doing a very good job of dealing with issues such as the difficulty of looking for an image in the British Library collection, the dazzling irrelevance of Web search results, and trivial matters such as the online security glitches experienced by outfits which like to think they are the best and brightest around.

The Dark Matter write up confuses me. The notion of Dark Matter is that “something” is there, but it cannot be located. I don’t want to call it a physicist cheat, but darn it, if one can’t find it, maybe the notion is flawed in some way.

The write up informed me that I come into contact with “internal tools.” Well, no. I think internal tools like the other points in the write up are business processes manifested in interactions with other systems and people. These processes, if not worked out correctly, add friction to a system. Who wants to change a mainframe based system into a cloud service for free or for fun? I don’t, and I don’t know too many people who would or could. Pain, gentle reader, pain is migrating an undocumented mainframe system to a cloud hybrid confection. Nope.

The write up’s points — monetization, security, localization (which I don’t understand), long tail features (but I don’t understand the word “bajillion” either), and micro optimizations (again, baffled).

Nevertheless, the write up sparked my thoughts about the invisible, yet cost adding, functions that are not on the users’, customers’, competitors’, or consultants’ radar. Big outfits have big friction. Inefficiency is the name of the game. Now that’s Dark Matter I find interesting.

The second article struck a chord because it focuses on the relationship between complexity and confusion. The write up is more coherent than the first article. I highlighted this passage:

Brazier [a wizard from Canalys] said “rising levels of complexity” were marking it “harder for customers to keep up with everything.” This in turn made it harder for customers to make decisions, he concluded. “Prices are going up. That has clearly restricted demand.”

The complexity thing linked with confusion and prices.

The magic of juxtaposition. Technology outfits, particularly those engaged in information access, have a tough time explaining what their products do, what the products’ value is, and why the information access systems anger half or more of their users.

Consultants explain the problem in terms of governance, a term a bit like bajillions. Sounds good, means nothing. Consultants (often failed webmasters trying to get “real” work or art history majors with a knack for Photoshop) guide the helpless procurement team to a decision.

Based on my brush againsts with these groups, the choices are narrowed to established companies which are pitching software which may not work. Often a deal will be made because someone knows someone. A personal endorsement is better than an Instagram factoid.

I have three notions floating around in my mental mine drainage pond:

- Technology centric companies are faced with rising technology costs and may have fewer and fewer ways to generate more cash. Not good for investors, employees, and customers. Googlers call this the rising cost of technology’s credit card debt.

- The problems which seem to crop up with outfits like Amazon, Facebook, Google really gum up the lives of users, partners, and others involved with the company. Whether know how based like Google’s Belgium glitch or legal like the European Commission’s pursuit of monopolists, costs will be driven up.

- The notion of guidance is becoming buck passing and derrière shielding. Those long, inefficient, circular procurement processes defer a decision and accountability.

Net net: Process friction, confusion, complexity, and cost increases. The new hot buttons for information access and other technology centric companies.

Stephen E Arnold, October 7, 2015

Big Data: Systems of Insight

October 6, 2015

I read “All Your Big Data Will Mean Nothing without Systems of Insight.” The title reminded me of the verbiage generated by mid tier consulting firms and adjuncts teaching MBA courses at some institutions of higher learning. Malarkey, parental advice, and Big Data—a Paula Dean-type recipe for low-calorie intellectual fare.

Can one live on the outputs of mid tier consulting firm lingo prepared to be fudgier?

The notion of a system of insight is not particularly interesting. The rhetorical trip of moving from a particular to a more general concept fools some beginning debaters. For a more experienced debater, the key is to keep the eye on the ball, which, in this case, is the tenuous connection between Big Data and strategic management methods. (I am not sure these exist even after reading every one of Peter Drucker’s books.)

But I like to deal with particulars.

Computerworld is a sister or first cousin unit of the IDC outfit which sold my research on Amazon without asking my permission. My valiant legal eagle was able to disappear the report. I was concerned with the connection of my name and the names of two of my researchers with the IDC outfit. I have presented some of the back story in previous blog posts. I included screenshots along with the details of not issuing a contract, using content in ways to which I would never agree, and engaging in letters with my attorney offering inducements to drop the matter. Wow. A big company is unable to get organized and then pays its law firm to find a solution to the self created problem.

The report in question was a limp wristed, eight pages in length and available to Amazon’s eager readers of romance novels for a mere $3,500. Hey, the good stuff in our research was chopped out, leaving a GrapeNut flakes experience for those able to read the document. I am a lousy writer, but I try to get my points across in a colorful way. Cereal bowl writing is not for me.

What does this have to do with Big Data and a system of insights?

Aren’t Amazon’s sales data big? Isn’t it possible to look at what sells on Amazon by scanning the company’s public information about books? Won’t a casual Google search reveal information about Amazon’s best selling eBooks? Best sellers’ lists rarely feature eight pages of watered down analysis of a search vendor with some soul bonding with the outstanding Fast Search & Transfer operation. How many folks visiting the digital WalMart buy $3,500 reports with my name on them?

Er, zero. So what’s the disconnect between basic data about what sells on Amazon, issuing appropriate contractual documents, and selling research with my name and two of my goslings on the $3,500, eight page document. That’s brilliant data analysis for sure.

The write up explains:

Businesses want to use data to understand customers, but they can’t do that without harnessing insights and consistently turning data into effective action.

That sort of makes sense except that the company which owns Computerworld, under the keen-eyed Dave Schubmehl, appeared to ignore this step when trying to sell a report with my name on it to the Amazon faithful. Do the folks at Computerworld and the company’s various knowledge properties connect data with their colleagues’ decisions?

Video Traffic Magnitude

October 5, 2015

Short honk: I read “Facebook v. Google in Digital Video Battle: YouTube Is 11X Bigger.” The big factoid is in the headline: Facebook is a fraction of the size in terms of traffic than YouTube. A couple of thoughts: How rapidly is Facebook growing in video content compared to YouTube? What is Facebook’s monetization opportunity compared to the Alphabet Google’s opportunity? The chit chat I have heard is that Facebook’s growth in the last 18 months is more rapid that the Alphabet Google video revenue growth? I also have a suspicion that socially anchored monetization may generate a more stable stream of revenue for Facebook. My question, however, is, “When will Facebook surpass YouTube in revenue from video?”

Stephen E Arnold, October 5, 2015

Conference Criticism: A New Genre for Tech News

October 3, 2015

I don’t really do conferences. A couple of times a year I give a lecture for an outfit involved in training law enforcement and intelligence professionals. But no more of the jaunts to “summits” about digital topics. Please, do we need another Big Data, search engine optimization, or Bitcoin event for start ups?

I am officially summited out.

When I was working, I never obsessed over conferences. Most of them were excuses for folks to congregate at breaks and “parties” to meet and greet, to sell and be sold. The presentations at most conferences do not age well. You can test the validity of this observation by navigating to Slideshare or any other archive of presentations and enter a key word or phrase; for example, search, Big Data, SEO, or business intelligence. Then eyeball the results list. Pick a presentation from several years ago. View it. (Note that you may have to register to access this LinkedIn content service.)

Familiar? Do you see the same buzzwords, the same problems, and the same solutions. Most of the conferences I have experienced are into truisms, recycling marketing lingo, and the aforementioned “networking.”

It is tough to sell some products and services, so when there is a shot at a captive audience, conference organizers go for the gold.

I was, therefore, surprised when I read “Is Web Summit a Scam? Well, If You Have to Ask.” I think a new branch of marketing criticism may be taking flight.

There were earlier exchanges about this event. One of them is called “Is Web Summit a Scam? Setting the Record Straight.” I don’t want to dig into the he said, she said of this event. Online marketing seems to be a point of contention. Be forewarned. The blog posts contain some salty language, which would make a LinkedIn moderator leap into action. No quips in Latin in this Web Summit dust up.

Let’s step back. Conferences are an important part of some professionals’ work and real lives. Conferences are very expensive to produce. Conferences try to monetize everything the organizers can think to slap a price tag on. For example, a sponsor can buy in at a gold, silver, or bronze level. A company can lease a booth space, put folks in it, and pay for the staff, shipping both booth and human cargo, and mouse pads handed out to those who stop at the booth for a mouse pad or a mint. People can pay to use the registration list as a list of folks to spam with PR baloney, webinars (invariably boring and skewed to inside baseball information), and the “right” to host a cocktail party, buy lunch, etc.

The problem is that many conferences are just not working. Forget Comdex. I don’t want to point out a UK event that went downhill for a decade and then has been reinvented and put on life support. Vendors grouse that attendees are not plentiful nor equipped with allocated funds and ready to spend.

A recent event in Louisville, Kentucky, promoted itself as attracting hundreds of qualified information technology buyers. I have it from an actual attendee that on the first day of the event, one of the featured speakers had 45 people in the audience. Some speakers flew in from the Left or Right Coast. Were these folks happy? Nope. What about the exhibitors? Were they happy? From what I heard, the answer is, “Nope.”

If I attended more conferences, I would cover them with a critical eye. Perhaps another person will fill the unmet need for critical commentary about technology events? My hunch is that hard hitting discussion of silly presentations, angry exhibitors, and frustrated attendees who are looking for a job would be helpful to some people.

Several observations:

- Conferences coalesce around topics for which their is a payoff for stakeholders; for example, venture-entrepreneur dating events

- A community is necessary to make a conference sustainable. My rule of thumb is, “No community, no money.”

- Certain types of conferences are a reaction to the failure of specialist events open to anyone; for example, MarkLogic hosts a conference and controls who gets in and what messages are disseminated. These conference offer control, which is important to companies perceiving themselves as misunderstood or important enough to go it alone.

- Many events have a side door. Some low tier and mid tier consulting firms offer a “pay to play” model for conferences run under the consulting banner. The goal is to showcase high value information. The winners are the attendees who get the inside scoop, the vendors who are showcased in the “pay to play” model, and the sponsoring consulting firm which gets it brand message in front of “decision makers.”

- There are conferences which are built on trends. The best example I have encountered is the explosion of Bitcoin and security conferences.

- There are conferences which “run the game plan.” Wow, these conferences are the same year after year. The tip off that a “game plan” conference is underfoot is one or more characteristics: [a] Multiple events in one venue with each promoted to a different market sector, [b] The same speakers appearing year after year, [c] One speaker giving two or more talks on what are described as completely different talks but are often the same old message recycled.

I look forward to the next installment of the Web Summit conference Bildungsroman. (I better be careful. I was criticized for quoting a quip from the Roman satirist Marcus Valerius Martial. I even presented Martial’s in Latin. Martial died in 104 CE or AD for oldsters.) The German word is probably less likely to twist a Latin student’s snoot.

Maybe next time?

Stephen E Arnold, October 3, 2015

A Xoogler Predicts Spike in Online Ad Rates

October 2, 2015

Yep, AOL, which is now part of Verizon, is not the world beater it was in the days of CD ROM spam. Today’s AOL top dog is a former Google wizards, officially known as a Xoogler.

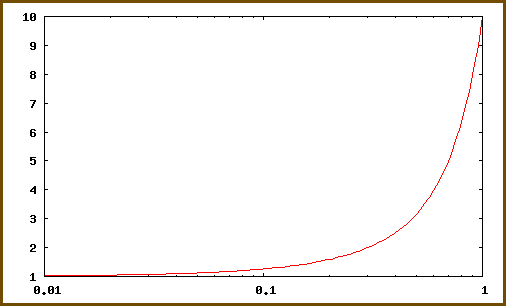

The Xoogler makes an interesting observation, faithfully recorded for the Mad Ave types in “Why AOL’s Tim Armstrong Says Advertising Is about to Get Exponentially More Expensive.” I like the word exponentially. It triggers this type of image in my mind:

Think Super Bowl or pre-indictment World Cup ad rates.

The write up reports that wizard Xoogler says:

“Everyone is spending all their time talking about ad blocking right now,” he said. “Everyone should be spending all of their time talking about why consumers feel the need to block ads.”

The fix, therefore, is more money to reach consumers:

“You’re going to have to pay a lot of money to convert someone,” Mr. Armstrong said.

Good news for the Google? Opportunities for other online ad vendors like Facebook?

Stephen E Arnold, October 2, 2015