AI Bubble? What Bubble? Bubble?

December 5, 2025

Another dinobaby original. If there is what passes for art, you bet your bippy, that I used smart software. I am a grandpa but not a Grandma Moses.

Another dinobaby original. If there is what passes for art, you bet your bippy, that I used smart software. I am a grandpa but not a Grandma Moses.

I read “JP Morgan Report: AI Investment Surge Backed by Fundamentals, No Bubble in Sight.” The “report” angle is interesting. It implies unbiased, objective information compiled and synthesized by informed individuals. The content, however, strikes me as a bit of fancy dancing.

Here’s what strikes me as the main point:

A recent JP Morgan report finds the current rally in artificial intelligence (AI) related investments to be justified and sustainable, with no evidence of a bubble forming at this stage.

Feel better now? I don’t. The report strikes me as bank marketing with a big dose of cooing sounds. You know, cooing like a mother to her month old baby. Does the mother makes sense? Nope. The point is that warm cozy feeling that the cooing imparts. The mother knows she is doing what is necessary to reduce the likelihood of the baby making noises for sustained periods. The baby knows that mom’s heart is thudding along and the comfort speaks volumes.

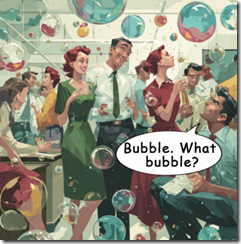

Financial professionals in Manhattan enjoy the AI revolution. They know there is no bubble. I see bubbles (plural). Thanks, MidJourney. Good enough.

Sorry. The JP Morgan cooing is not working for me.

The write up says, quoting the estimable financial institution:

“The ingredients are certainly in place for a market bubble to form, but for now, at least, we believe the rally in AI-related investments is justified and sustainable. Capex is massive, and adoption is accelerating.”

What about this statement in the cited article?

JP Morgan contrasts the current AI investment environment to previous speculative cycles, noting the absence of cheap speculative capital or financial structures that artificially inflate prices. As AI investment continues, leverage may increase, but current AI spending is being driven by genuine earnings growth rather than assumptions of future returns.

After stating the “no bubble” argument three times, I think I understand.

Several observations:

- JP Morgan needed to make a statement that the AI data center thing, the depreciation issue, the power problem, and the potential for an innovation that derails the current LLM-type of processing are not big deals. These issues play no part in the non-bubble environment.

- The report is a rah rah for AI. Because there is no bubble, organizations should go forward and implement the current versions of smart software despite their proven “feature” of making up answers and failing to handle many routine human-performed tasks.

- The timing is designed to allow high net worth people a moment to reflect upon the wisdom of JP Morgan and consider moving money to the estimable financial institution for shepherding in what others think are effervescent moments.

My view: Consider the problems OpenAI has: [a] A need for something that knocks Googzilla off the sidewalk on Shoreline Drive and [b] more cash. Amazon — ever the consumer’s friend — is involved in making its own programmers use its smart software, not code cranked out by a non-Amazon service. Plus, Amazon is in the building mode, but it has allegedly government money to spend, a luxury some other firms are denied. Oracle is looking less like a world beater in databases and AI and more of a media-type outfit. Perplexity is probably perplexed because there are rumors that it may be struggling. Microsoft is facing some backlash because of its [a] push to make Copilot everyone’s friend and [b] dealing with the flawed updates to its vaunted Windows 11 software. Gee, why is FileManager not working? Let’s ask Copilot. On the other hand, let’s not.

Net net: JP Morgan is marketing too hard, and I am not sure it is resonating with me as unbiased and completely objective. As sales collateral, the report is good. As evidence there is no bubble, nope.

Stephen E Arnold, December 5, 2025

Comments

Got something to say?