Want to Catch the Attention of Bad Actors? Say, Easier Cross Chain Transactions

September 24, 2025

This essay is the work of a dumb dinobaby. No smart software required.

This essay is the work of a dumb dinobaby. No smart software required.

I know from experience that most people don’t know about moving crypto in a way that makes deanonymization difficult. Commercial firms offer deanonymization services. Most of the well-known outfits’ technology delivers. Even some home-grown approaches are useful.

For a number of years, Telegram has been the go-to service for some Fancy Dancing related to obfuscating crypto transactions. However, Telegram has been slow on the trigger when it comes to smart software and to some of the new ideas percolating in the bubbling world of digital currency.

A good example of what’s ahead for traders, investors, and bad actors is described in “Simplifying Cross-Chain Transactions Using Intents.” Like most crypto thought, confusing lingo is a requirement. In this article, the word “intent” refers to having crypto currency in one form like USDC and getting 100 SOL or some other crypto. The idea is that one can have fiat currency in British pounds, walk up to a money exchange in Berlin, and convert the pounds to euros. One pays a service charge. Now in crypto land, the crypto has to move across a blockchain. Then to get the digital exchange to do the conversion, one pays a gas fee; that is, a transaction charge. Moving USDC across multiple chains is a hassle and the fees pile up.

The article “Simplifying Cross Chain Transaction Using Intents” explains a brave new world. No more clunky Telegram smart contracts and bots. Now the transaction just happens. How difficult will the deanonymization process become? Speed makes life difficult. Moving across chains makes life difficult. It appears that “intents” will be a capability of considerable interest to entities interested in making crypto transactions difficult to deanonymize.

The write up says:

In technical terms,

intentsare signed messages that express a user’s desired outcome without specifying execution details. Instead of crafting complex transaction sequences yourself, you broadcast your intent to a network ofsolvers(sophisticated actors) who then compete to fulfill your request.

The write up explains the benefit for the average crypto trader:

when you broadcast an intent, multiple solvers analyze it and submit competing quotes. They might route through different DEXs, use off-chain liquidity, or even batch your intent with others for better pricing. The best solution wins.

Now, think of solvers as your personal trading assistants who understand every connected protocol, every liquidity source, and every optimization trick in DeFi. They make money by providing better execution than you could achieve yourself and saves you a a lot of time.

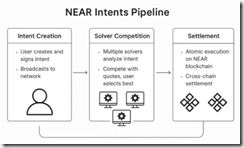

Does this sound like a use case for smart software? It is, but the approach is less complicated than what one must implement using other approaches. Here’s a schematic of what happens in the intent pipeline:

The secret sauce for the approach is what is called a “1Click API.” The API handles the plumbing for the crypto bridging or crypto conversion from currency A to currency B.

If you are interested in how this system works, the cited article provides a list of nine links. Each provides additional detail. To be up front, some of the write ups are more useful than others. But three things are clear:

- Deobfuscation is likely to become more time consuming and costly

- The system described could be implemented within the Telegram blockchain system as well as other crypto conversion operations.

- The described approach can be further abstracted into an app with more overt smart software enablements.

My thought is that money launderers are likely to be among the first to explore this approach.

Stephen E Arnold, September 24, 2025